Green Banking - An Overview

A green banking system is different from traditional banking. It is any concept of promoting sustainable development in a country.

Green Banking is a new phenomenon in the financial world concentrated on environment and social responsible investing.

Green Banking is also called Ethical or Sustainable Banking.

It encourages banks to carried out environmental-friendly investment by combining its operational improvements and technological developments.

Do we need a Green Banking System?

Yes, because green banking system if the household are able to switch to paperless bank building this would save an estimated of 1 crore 65 lakh per year or about 46,000 of acres of forest, 3,96,000 tons of carbon dioxide a year and 4 lakh 95 thousands of tons of air pollution per year and gain almost 21 lakhs 45,000 tons of oxygen per year.

What are the going Green Initiatives?

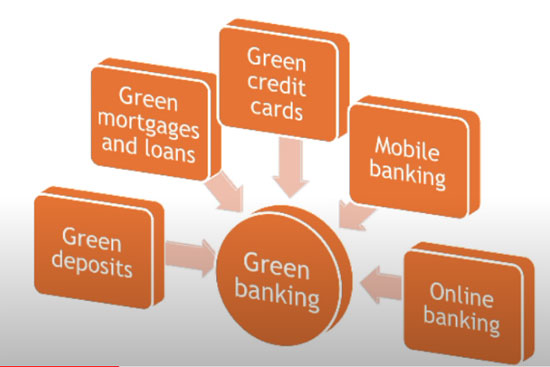

The Green Banking has:

- Green Deposits

- Green Markets and Loans

- Green Credit Cards

- Mobile Banking

- Online Banking

Benefits of Green Banking Systems

1. Basically the green making is the main intention is the reduction of paper working Bank. Less paper worse it's to less cutting of trees.

2. Creating awareness for the bank as well as the customers about the environment and social responsibility.

3. Under Green making it provide a loan for eco-friendly activity and interest is compared to less than the normal bank.

4. Green Banking provides rewards to customers if they are contributing to environmentally friendly and non-for-profit organizations.

5. Free electronic bill payment services

6. Green banking follows environmental standards for lending purposes.

7. Free online account opening for opening Green Bank opens.

Challenges of Green Banking System

1. Diversification Problems

Green banking is restricting their business transaction to those business entities who qualify screening processes done by Green Banks with limited number of customers they will have a small smaller base to support them.

2. Startup Phase

Many banks in Green Bank in green businesses are very new and are in the startup phase generally it takes three to four years for a bank to start making money thus it does not help to bank during the recession.

3. Credit operating / High operating cost

Green Banks requires talented and experienced staffs to provide proper services to customer experiences loan officers and needed or needed.

They give additional experience in dealing with green businesses and customers.

4. Reputation Risk

Green bank required talented and experienced tasks to provide a proper service to customer.

Experience alone officers are needed.

They give additional experience in dealing with the green business and the customer.

5. Credit Risk

Credit risk arises due to lending to those customers those businesses are affected by the cost of pollution changing the environmental regulations and new requirements of emission level.

Research Objectives

1. Studying the existing greenbacks green mending initiatives.

2. Studying the issues and challenges are facing during the adoption of green banking systems in the bank.

3. To understand the examine the green banking processes in the banks

4. To elicit the earth role of green banking in sustainable development at an economy

Conclusion:

Green Banking is one of the important concepts for the banking sector and the economy because it helps reduces carbon footprints and conserve natural resources and protect the environment.

No comments:

Post a Comment